Learn the benefits of a 529 plan

What is a 529 plan?

A 529 plan is a tax-advantaged savings vehicle within the United States designed to save for future higher education expenses for a specified beneficiary.

What savings options are available to you?

Comparing education savings plan.

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| Contributions made with after-tax dollars. Earnings grow tax-free. Withdrawals for qualified education expenses are free from federal income tax | Contributions made with after-tax dollars. Earnings grow tax-free. Withdrawals for qualified education or K-12 expenses are free from federal income tax | Earnings and capital gains are taxed at the minor’s tax rate | Earnings taxable at account owner’s tax rate |

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| Contributions are treated as gifts; annual gift tax exclusion is up to $19k (single) or $38k (joint) per beneficiary. $95k (single) or $190k (joint) prorated over 5 years | Contributions are treated as gifts, annual gift tax exclusion of up to $19k (single) or $38k (joint) per beneficiary | Gifts and transfers to the minor are treated as completed gifts - $19k (single) or $38k (joint) as an annual gift exclusion | Differs by individual, consult tax advisor |

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| Amount removed from donor’s estate, partial inclusion up to $95k ($190k filing jointly) if donor’s death occurs within the 5-year election period | Amount removed from donor’s estate | Amount removed from donor’s estate unless donor remains as custodian | Differs by individual, consult tax advisor |

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| Determined by program. Scholar’s Edge is $500,000 | $2,000 per beneficiary per year from all sources | No limit | Not applicable, can be used for any purpose |

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| Yes, to another member of the beneficiary’s family, dependent upon plan | Yes, to another member of the beneficiary’s family, dependent upon plan | No, represents a gift to the child | Not applicable |

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| None | Ability to contribute phases out for income $95k-$110k (single) or $190k-$220k (joint) | None | None |

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| Tuition, fees, books, computers and related equipment, supplies, special needs, room and board for half-time students, and up to $20,000 in qualified expenses at K-12 schools (state dependent) | Tuition, fees, books, equipment, supplies, special needs, room and board for half-time students, some K-12 expenses | No restrictions | No limit |

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| If parent is account owner, assessed at up to 5.64% as an asset of the parent | If parent is account owner, assessed at up to 5.64% as an asset of the parent | Counted as the student’s asset and assessed at 20% | Counted as assets of the account owner assessed at up to 5.64% if owned by the parent |

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| Account owner selects the investment portfolio within the plan | Range of securities and investments chosen by the account owner | Chosen by the custodian until child reaches majority | Chosen by account owner |

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| May be subject to federal income tax and a 10% federal tax penalty as well as state and local taxes | May be subject to federal income tax and a 10% federal tax penalty as well as state and local taxes | Funds must be used for benefit of the minor | Chosen by account owner |

| 529 plans | Coverdell education savings account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|

| None | Contributions can be made until beneficiary turns 18; account balance must be distributed by 30 days following beneficiary’s 30th birthday | Custodianship terminates when minor reaches majority under state law (typically 18 or 21) | None |

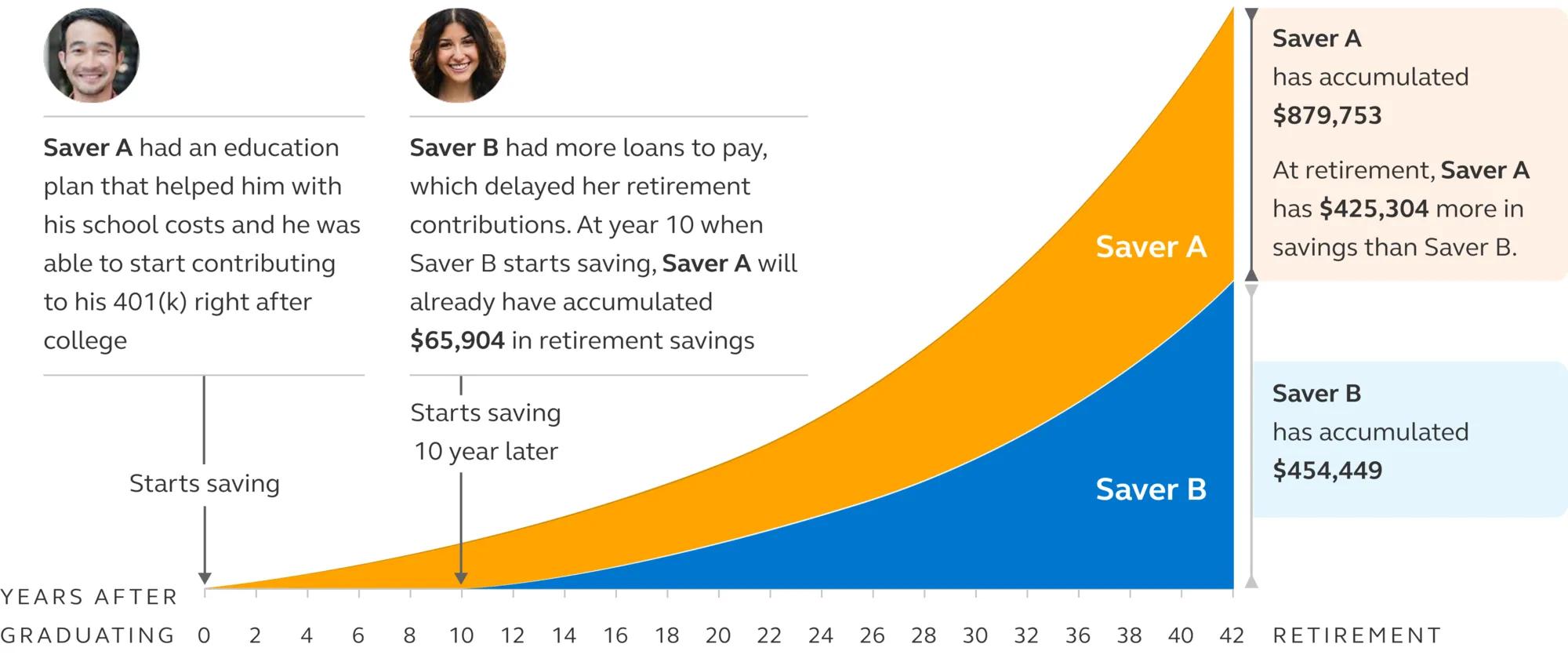

Saving for education can help in saving for retirement

How education saving can help with bigger goals

By graduating with less debt, the child in your life can begin investing and planning for life’s other milestones earlier.

A truly flexible savings vehicle

Available to anyone, regardless of income

Learn how your savings can potentially grow

The compounding effect of 529 tax benefit

Family A

Opened a taxable savings account

Family B

Invested in 529 plan

Flexibility for planning now, and in the future

Beyond education savings, 529 plans can help families leave a legacy. When considering whether to use a 529 plan in your estate plan. Keep in mind the following points:

Tax-free contributions

An individual may contribute up to $19,000 a year ($38,000 for married couple) per beneficiary without triggering the federal gift tax.

Accelerated gifting

Special gift and estate tax treatment allows an individual to contribute up to $95,000 ($190,000 for married couples) in one lump sum per beneficiary, free of federal gift taxes, under a provisions known as “Accelerated gifting”.

Non-taxable asset

For tax purposes the internal revenue service consider assets held in a 529 plan as a completed gift and therefore treats them as the beneficiary’s assets and not the account owner’s.

Tax free withdrawals

529 plan contributions and investments earnings may be withdrawn federal income tax free if the money is used for qualified higher education expenses (QHEE).

Complete control

The 529 plan owner maintains complete control over the account assets and is allowed to make beneficiary changes or even discontinue the account and take the money back.

Even more flexibility

No longer just for college

Families can now use their 529 plans to:

- Repay up to $10,000 (lifetime) in qualified student loans, under the Secure Act of 2019.

- Cover up to $20,000 (in 2026) per student per year for K-12 eligible expenses.

- Move assets to a Roth IRA, under the Secure Act 2.0.

Some tips for using 529 savings for K-12 expenses

Know your state’s tax handling

Some states have not adopted the Tax Cuts and Jobs Act updates. Withdrawing funds for K-12 tuition payments in a state that doesn’t follow the Federal SECURE Act could subject you to state tax penalties or your ability to claim credits/deductions could be affected. You may also trigger a 10% penalty on non-qualified withdrawals.

Start early

Consider contributing once your child is born rather than when they’re already at school age.

Make it a family affair

Get help from family to ensure you’re meeting both K-12 and college education milestones. It’s an excellent legacy planning opportunity.

Consider higher contributions

Maximizing your contributions can ensure that you have enough to fund both K-12 and post-secondary education.

Ensure your investment strategy is aligned

You may need to switch your savings approach or portfolio. Your financial professional can help you look at the big picture.

Dream

How do you make education dreams come true? Discover the many ways you can benefit from a 529 plan to achieve your educational goals.

Save

Investing in education savings now can help shape the future. Save for education with an experienced financial professional.

Start saving today

Dream big. Learn more. Save for the future.

Take the first step in securing your loved one’s education today with the Scholar’s Edge 529 Plan.