Myths about 529 plans

A Scholar’s Edge 529 account can help provide you with the opportunity to plan for and achieve your educational goals.

Myth #1

529s will affect a child’s eligibility for financial aid

Saving now means potentially borrowing less later

Sophie’s family:

Savings-focused education funding strategy.

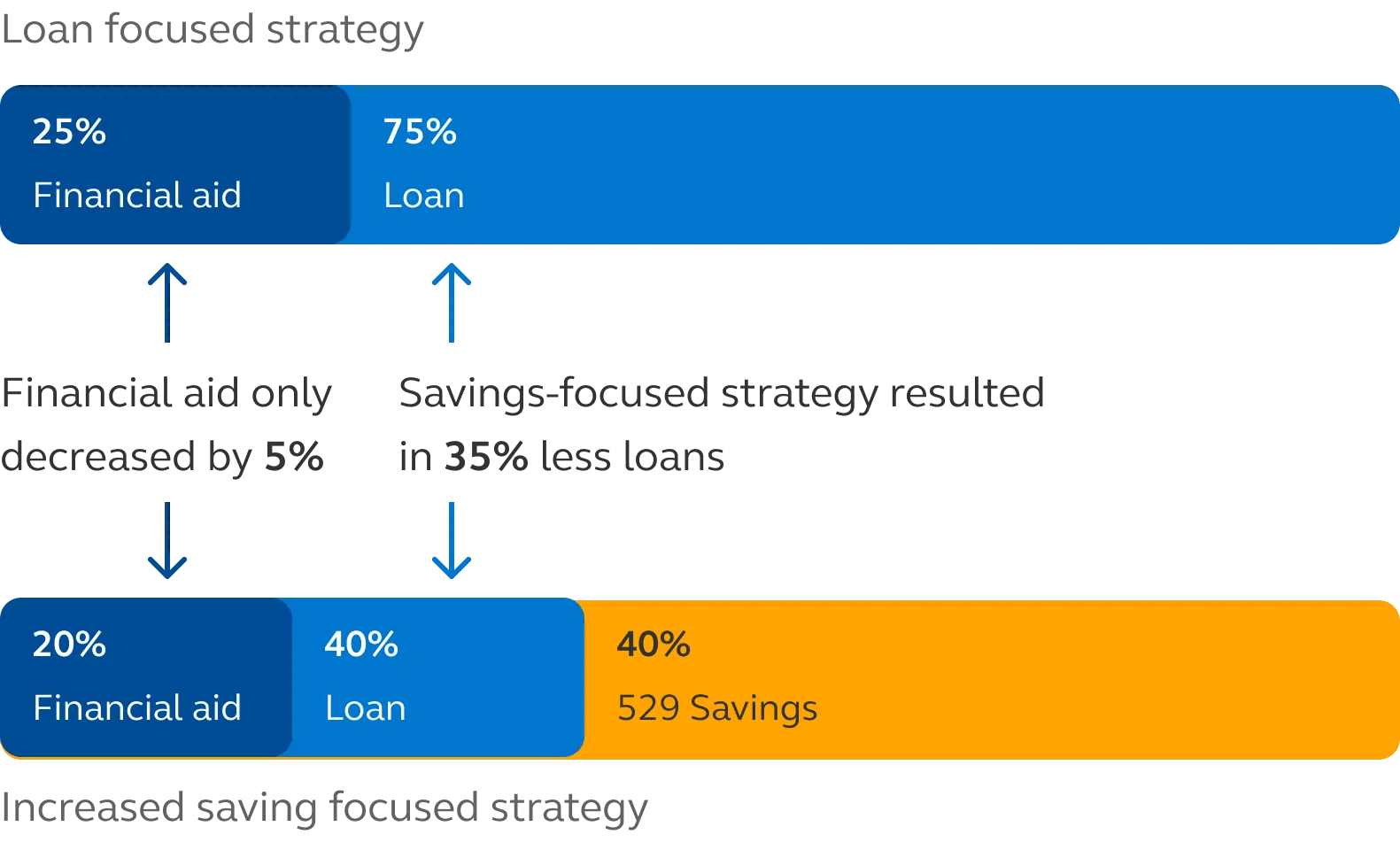

Assume Sophie’s education costs $100,000 and her family saved a portion of that in a 529 plan. This reduced the amount of loans she would have to take, but did not create a large reduction in the amount of financial aid received.

A 529 strategy reduces out of pocket costs and student loans

| Scenario | A family invested $247 monthly for 18 years in a 529 plan | A family invested $123 a month in a 529 plan. The student then takes out a student loan for $51,780 (payable over 10 years) | A student finances her entire $104,000 expense through student loans (repaying over 10 years) |

|---|---|---|---|

| Investment | |||

| Monthly investment | $247 | $123 | − |

| Years | 18 | 18 | − |

| Growth rate | 7% | 7% | − |

| Total invested | $53,352 | $26,635 | − |

| Future value | $104,554 | $52,197 | − |

| Loan |

|||

| Loan amount | − | $51,780 | $104,000 |

| Interest | − | 4.25% | 4.25% |

| Years of repayment | − | 10 | 10 |

| Monthly payment | − | $530 | $1,061 |

| Loan total/Debt | − | $63,650 | $127,301 |

| Total out of pocket | $53,352 | $90,285 | $127,301 |

The FAFSA form is easier to fill out—it’s shorter, has fewer questions and many fields are prepopulated by the IRS.

Old

108 detailed questions focusing on demographics, educational and identification questions.

New

A maximum of 36 questions that streamlines the process and draws information directly from tax forms.

A new measure, the SAI, replaces the EFC to determine the ability to pay for college. A lower SAI signifies higher financial need.

Old

EFC assessed a student’s available financial assets to determine financial need.

New

SAI can move into negative territory, as low as -1,500, to give greater insight into those families with exceptional need.

For dependent students, education savings will only be counted as a parental asset if the account is designated for the student.

Old

For parents with more than one child attending college, all 529 accounts were counted.

New

SAI treats each student as an individual and is not divided based upon the number of students attending college within the same family.

It’s now easier for grandparents to play a bigger part in funding a grandchild’s education.

Old

Funds withdrawn from a grandparent-owned 529 were included in the FAFSA “income test”.

New

Distributions from non-parent-owned 529 savings accounts, i.e. grandparent-owned, will not be counted as student untaxed income.

Pre-tax contributions to retirement accounts will no longer be counted in a family’s ability to pay for college.

Old

Families disclosed contributions to work-sponsored retirement accounts, which counted as income.

New

Work-sponsored accounts, including 401(k)s, IRAs and Roth IRAs are no longer included in FAFSA financial aid calculations.

If parents are divorced/separated, the parent that provides the greatest financial support to the student must fill out the FAFSA.

Old

The parent that files is the one the student lived with (or lived with most) in the 12 months prior to applying.

New

Parent providing the most financial support for the student in the 12 months prior to applying is the one that files. Child support is an asset, not income.

A closer look at applying for financial aid

Free Application for Federal Student Financial Aid (FAFSA®) needs to be applied for every year in college.

Each state also has its own deadline. For more info,

Year 1

Apply in high school

Year 2

Apply in year 1

Consider using 529 plan account owner by parents

Why?

Withdrawals from parent-owned 529s not considered student income.

Year 3

Apply in year 2

Year 4

Apply in year 3

Consider using 529 plan account owned by grandparents.

Why?

Withdrawals from grandparent-owned and other-owned plans are not included in SAI calculations.

Myth #2

I have to open a 529 plan in my home state

529 plans are state-sponsored, but that doesn’t always mean you have to use your in-state 529 plan to save for college. Any 529 plan can be used to pay for college in any state. You can use almost any state’s 529 plan, with very few exceptions where a residency requirement may exist.

Approximately 29 states offer a state income tax deduction or state income tax credit for 529 plan contributions.

Myth #3

I can just use my retirement savings for my child’s education savings

You lose the power of compounding. College withdrawals can jeopardize retirement security.

Dream

How do you make education dreams come true? Discover the many ways you can benefit from a 529 plan to achieve your educational goals.

Learn

It’s easier to achieve educational goals with the right planning. Learn the advantages of a 529 plan and how it can be used to benefit you.

Save

Investing in education savings now can help shape the future. Save for education with an experienced financial professional.

Start saving today

Dream big. Learn more. Save for the future.

Take the first step in securing your loved one’s education today with the Scholar’s Edge 529 Plan.