The benefits of higher education

Studies show that the higher the level of education achieved, the higher the average salary earned and lower the unemployment rate.

Source: U.S. Bureau of Labor Statistics, Current Population Survey, 2023.

Salary reported as median weekly earnings, data was annualized.

A rising bar: Education costs continue to increase

College costs are rising. The average undergraduate cost is now over $24,000.

This trend is unlikely to reverse in the near future.

Source: U.S. Department of Education, National Center for Education Statistics. Digest of Statistics, 2023. *Includes: tuition, fees, room & board. All institutions includes two and four-year institutions, both public and private. Note: Constant dollars based on the Consumer Price Index, prepared by the Bureau of Labor Statistics, U.S. Department of Labor, adjusted to an academic-year basis. For public institutions, in-state tuition and required fees are used.

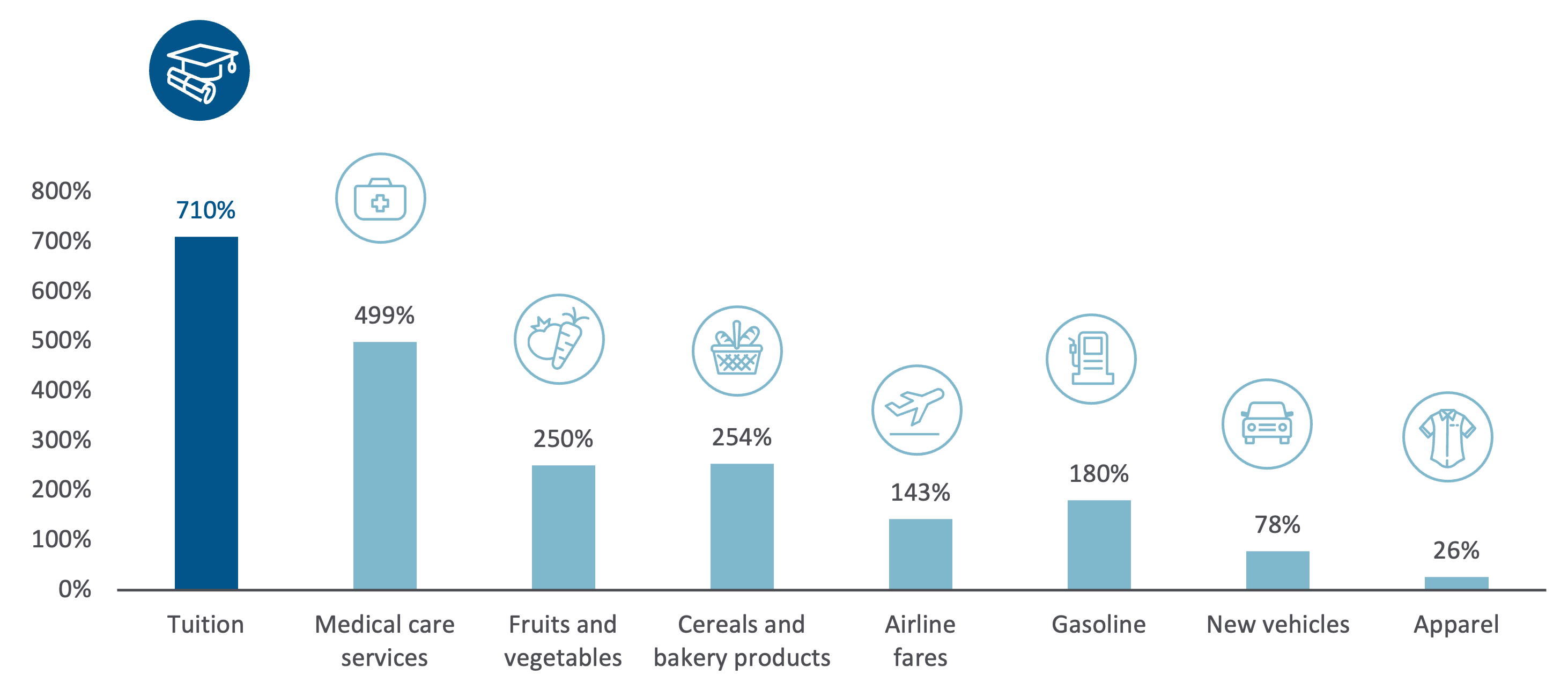

An impact to your wallet

Education costs compared to inflation

Over time, college costs have routinely outpaced inflation. As a result, education is taking a bigger piece of overall spending.

Source: Commonfund Institute: Higher Education Price Index (HEPI) 2023; U.S Bureau Labor Statistics Unemployment Rate.

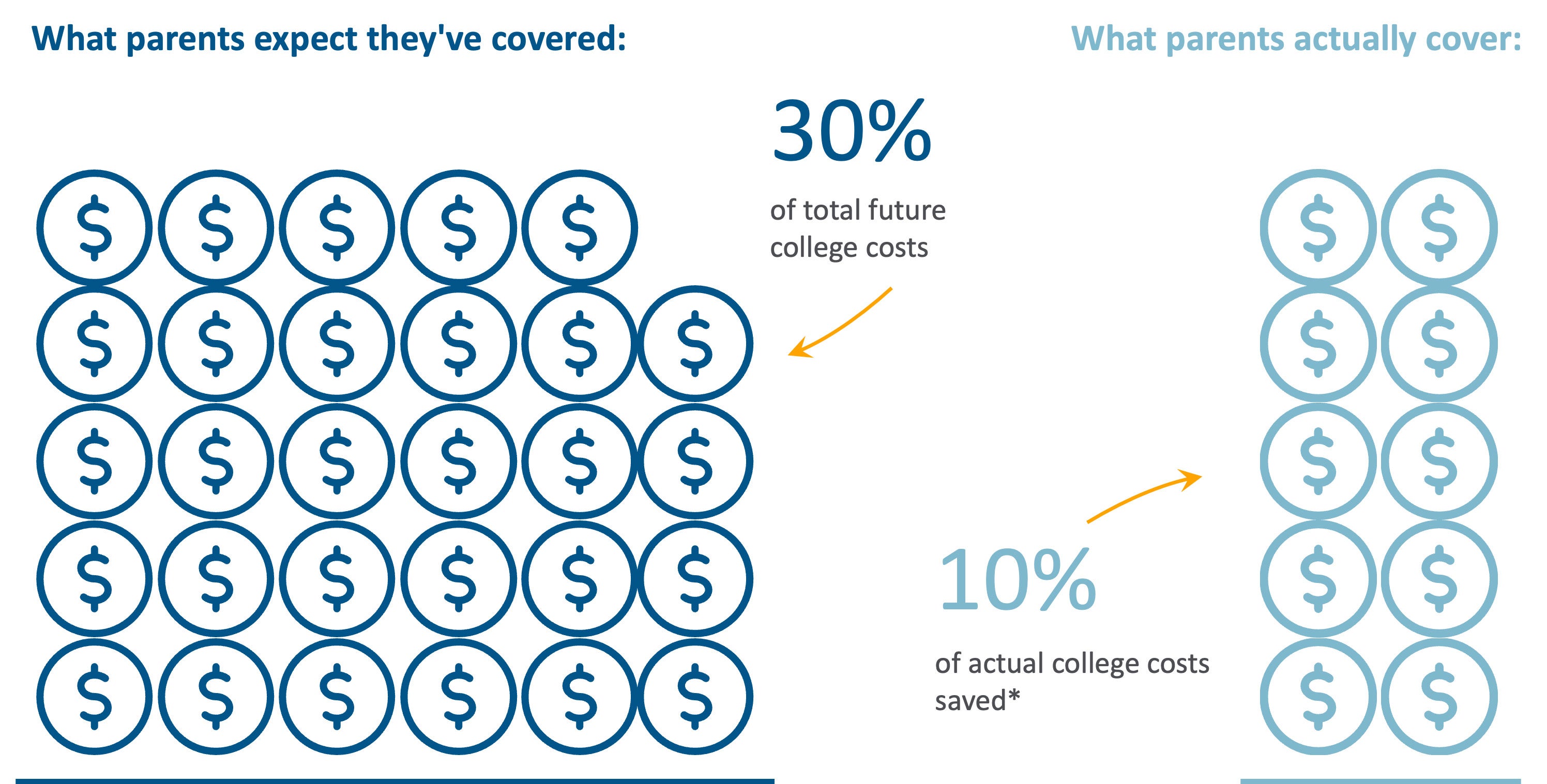

The education savings gap

People tend to underestimate how much they need to save for higher education expenses

Source: Educationdata.org college savings statistics Dec 2022

How do tuition costs stack up?

Tuition costs are rising at a faster rate than common household expenses

Tuition costs have spiked versus other expenses

Cumulative price change (%)

College cost inflation, what's driving it?

Competition for resources and faculty, and less support at the state level.

Tuition is based on the price increase from 1986/87 to 2023/24 from Trends in College Pricing 2023, CollegeBoard.

All other inflation figures based on original base value of 100 in 1982-1984 up until December 2023, from the U.S. Bureau of Labor Statistics, December 2023.

Don’t forget, tuition is just the tip of the iceberg

Room and board, books, laptops and clubs should be factored into any budgeting discussions about education.

Books & supplies: $1,250

Room and board: $12,770

Tuition & fees: $29,150

Transportation: $1,290

Other expenses: $2,270

Total: $46,730

Source: College Board Trends in College Pricing 2023. Based on public four-year, out-of-state, on-campus post-secondary education costs.

Financial aid is getting harder to come by

While costs continue to increase, the pool of available financial aid is decreasing

Source: College Board Trends in College Pricing and Student Aid 2023.

Average four-year scholarship amounts

Scholarships help, but they only cover a fraction of education costs

$18,013

Average athletic scholarship1

$12,088

Average merit-based scholarship2

$3,960

Average need-based scholarship3

- Remember, if a child earns a scholarship, the account owner can always transfer their 529 savings to another eligible family member.

- The account owner can also withdraw the amount of the scholarship but will be required to pay income tax on the earnings portion of the withdrawal.

Sources:

1 Average per athlete 2023, scholarshipstats.com.

2 13 Things to Know About Merit Aid Scholarships, usnews.com.

3 College Board Trends in College Pricing and Student Aid 2023.

Learn.

You can help a child change the world when you start with a plan

What is a 529 plan?

A 529 plan is a tax-advantaged savings vehicle within the United States designed to save for future higher education expenses for a specified beneficiary.

What savings options are available to you?

Comparing education savings plans

| Rules | 529 Plans | Coverdell Education Savings Account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|---|

| Federal income tax | Contributions made with after-tax dollars. Earnings grow tax-free. Withdrawals for qualified education expenses are free from federal income tax | Contributions made with after-tax dollars. Earnings grow tax-free. Withdrawals for qualified education or K-12 expenses are free from federal income tax | Earnings and capital gains are taxed at the minor's tax rate | Fully taxable at account owner's tax rate |

| Federal gift tax treatment | Contributions are treated as gifts; annual gift tax exclusion is up to $18k (single) or $36k (joint) per beneficiary. $90k (single) or $180k (joint) prorated over 5 years | Contributions are treated as gifts, annual gift tax exclusion of up to $18k (single) or $36k (joint) per beneficiary | Gifts and transfers to the minor are treated as completed gifts - $18k (single) or $36k (joint) as an annual gift exclusion | Differs by individual, consult tax advisor |

| Federal estate tax treatment | Amount removed from donor's estate, partial inclusion up to $85k ($170k filing jointly) if donor's death occurs within the 5-year election period | Amount removed from donor's estate | Amount removed from donor's estate unless donor remains as custodian | Differs by individual, consult tax advisor |

| Maximum investment | Determined by program. Scholar's Edge is $500,000 | $2,000 per beneficiary per year from all sources | No limit | Not applicable, can be used for any purpose |

| Ability to change beneficiary | Yes, to another member of the beneficiary's family, dependent upon plan | Yes, to another member of the beneficiary's family, dependent upon plan | No, represents a gift to the child | Not applicable |

| Income restriction | None | Ability to contribute phases out for income $95k-$110k (single) or $190k-$220k (joint) | None | None |

What savings options are available to you?

Comparing education savings plans

| Rules | 529 Plans | Coverdell Education Savings Account (CESA) | UGMA/UTMA | Taxable savings account |

|---|---|---|---|---|

| Qualified expenses | Tuition, fees, books, computers and related equipment, supplies, special needs, room and board for half-time students, and up to $10,000in tuition expenses at private, public, and religious K-12 schools (state dependent). According to the SECURE Act, you can now use 529 plans to repay up to $10,000 in qualified student loans. | Tuition, fees, books, equipment, supplies, special needs, room and board for half-time students, some K-12 expenses | No restrictions | No limit |

| Financial aid impact | If parent is account owner, assessed at up to 5.64% as an asset of the parent | If parent is account owner, assessed at up to 5.64% as an asset of the parent | Counted as the student's asset and assessed at 20% | Counted as assets of the account owner. Assessed at up to 5.64% if owned by the parent |

| Investments | Account owner selects the investment portfolio within the plan | Range of securities and investments | Chosen by the custodian until child reaches majority | Chosen by account owner |

| Non-qualifying expenses | May be subject to federal income tax and a 10% federal tax penalty as well as state and local taxes | May be subject to federal income tax and a 10% federal tax penalty as well as state and local taxes | Funds must be used for benefit of the minor | Chosen by account owner |

| Age restrictions | None | Contributions can be made until beneficiary turns 18; account balance must be distributed by 30 days following beneficiary's 30th birthday | Custodianship terminates when minor reaches majority under state law (typically 18 or 21) | None |

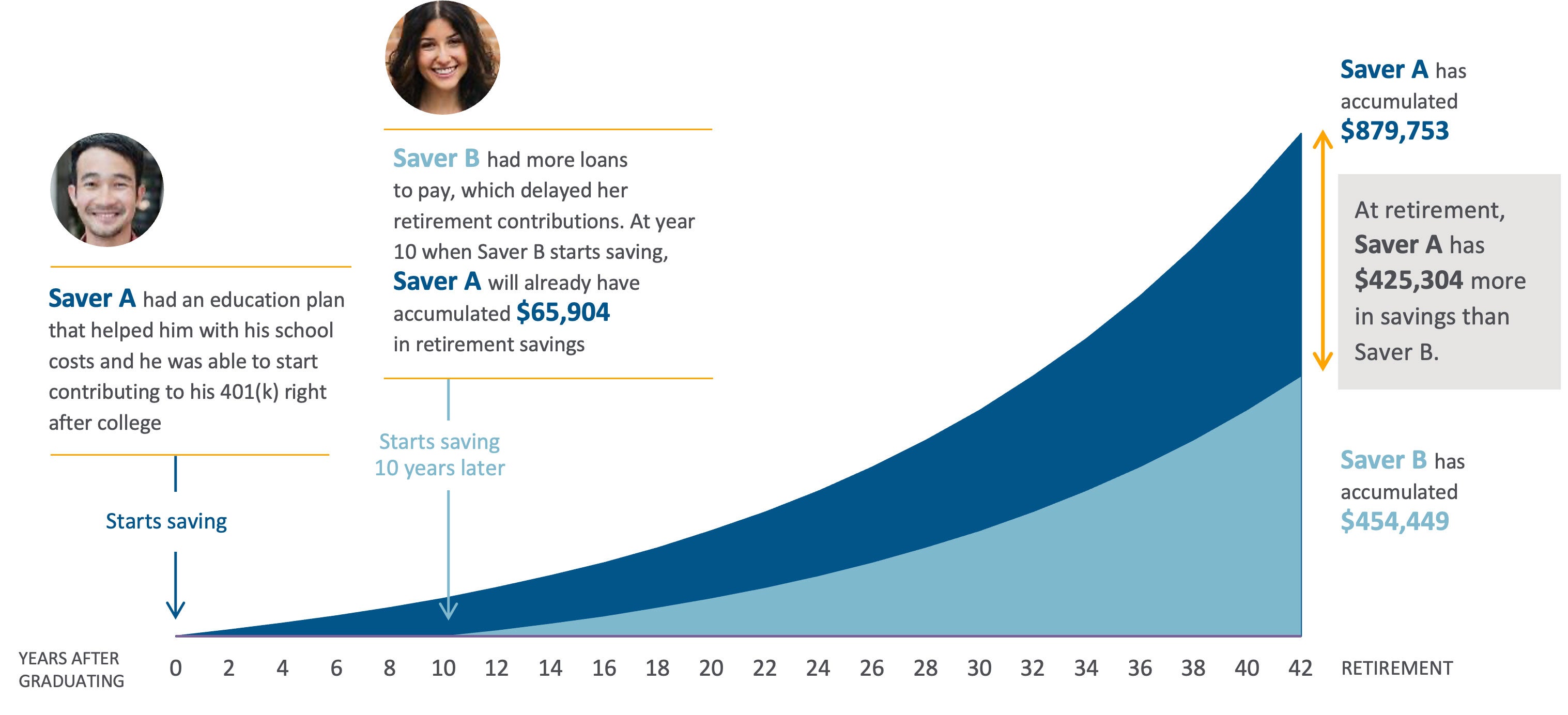

Saving for education can help in saving for retirement

How education savings can help with bigger goals

By graduating with less debt, the child in your life can begin investing and planning for life’s other milestones earlier.

Assumes $5,000 saved per year for 42 years with a compounded annual return of 6% each year. This hypothetical example is for illustration purposes only and does not represent the performance of any specific investment. Investment returns are not guaranteed and you can lose money by investing.

A truly flexible savings vehicle

Available to anyone, regardless of income

Key features of a 529 plan

Tax benefits

Earnings grow tax-deferred and qualified withdrawals are tax-free from federal taxes and may also be free from state taxes

Gifting and estate planning

Contribute up to $18,000 per beneficiary annually ($36,000 filing jointly)

Make an $90,000 contribution ($180,000 filing jointly) that can be treated as being made over 5 years for gift tax recognition purposes

Withdrawals

Proceeds can be used at eligible institutions around the country

Qualified expenses have no annual distribution limit

529 plans can now be used for K-12 enrollment ($10,000 limit)

Learn how your savings can potentially grow

The compounding effect of 529 tax benefits

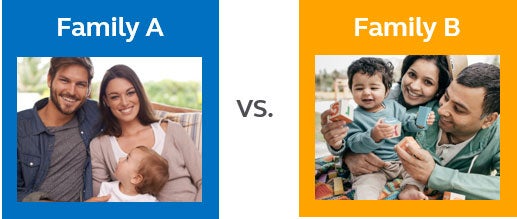

EXAMPLE: Two families invested differently. Family A opened a taxable savings account while Family B invested in a 529 plan.

Both families opened their savings accounts with an initial deposit of $1,000 and opted for monthly contributions of $150. Both families saved for 18 years, earning 7% on their investment.

These hypothetical examples are for illustrative use only and do not reflect an actual investment in any specific 529 plan. Families are assumed to be in the 24% tax bracket during contribution and distribution. The hypothetical examples assume a monthly contribution of $150, return on investment of 7% and no withdrawals during the 18 years. Actual returns may vary. Investment returns are not guaranteed and you can lose money by investing in Section 529 Education Savings Plans. Participation in a 529 plan does not guarantee the investment return on contributions, if any, will be adequate to cover future tuition and other higher education expenses.

Getting the most out of your state benefit

Tax benefits by state

New Mexico

Home of Scholar's Edge 529.

Tax Neutral

These states do not offer tax deductions or credit for 529 contributions, or have no state income tax.

Tax Parity

These states offer tax deductions or credit for contributions to any 529 plan, regardless of state.

In-state Tax Benefit

These states offer tax deductions or credit for contributions to the in-state 529 plan only.

Hover over each state to view the tax benefits per state.

As of January, 2024.

529 plans offer many advantages to investors saving for education, including tax-deferred earnings and tax-free qualified withdrawals. Additionally, certain states offer state income tax benefits. It is important to review all potential tax benefits within your state, along with the performance and expense information of the 529 plan you are considering, before making a selection. Earnings on non-qualified withdrawals may be subject to federal income tax as well as state and local income taxes. Taxes and other benefits are contingent upon certain requirements and certain withdrawal are subject to federal, state and local taxes.

Flexibility for planning now … and in the future

Beyond education savings, 529 plans can help families leave a legacy

When considering whether to use a 529 plan in your estate plan, keep in mind the following key points:

| Contributions | Accelerated gifting | Tax planning | Tax-free withdrawals | Control |

|---|---|---|---|---|

| An individual may contribute up to $18,000 a year ($36,000 for a married couple) per beneficiary without triggering the federal gift tax.1 | Special gift and estate tax treatment allows an individual to contribute up to $90,000 ($180,000 for married couples) in one lump sum per beneficiary, free of federal gift taxes, under a provisions know as "accelerated gifting". Learn more about contributions and gifts |

For tax purposes the Internal Revenue Service considers assets held in a 529 plan as a completed gift and therefore treats them as the beneficiary's assets and NOT the account owner's. | 529 plan contributions and investment earnings may be withdrawn federal income tax free if the money is used for Qualified Higher Education Expenses (QHEE).2 | The 529 plan owner maintains complete control over account assets and is allowed to make beneficiary changes or even discontinue the account and take the money back.2 |

1The gift-tax exclusion applies, provided the 529 account owner makes no other gifts to the beneficiary during a five-year period. Contributions between $18,000 and $90,000 ($36,000 and $180,000 for married couples filing jointly) made in one year may be prorated over a five-year period without subjecting the donor(s) to federal gift tax or reducing his/her federal unified estate and gift tax credit. If an individual contributes less than the $90,000 maximum ($180,000 for married couples filing jointly) additional contributions may be made without subjecting the donor to federal gift tax, up to prorated level of $18,000 ($36,000 for married couples filing jointly) per year. Gift taxation may result if a contribution exceeds the available annual gift tax exclusion amount remaining for a given beneficiary in the year of contribution. If the account owner dies before the end of the five-year period, a prorated portion of contributions between $18,000 and $90,000 ($36,000 and $180,000 for married couples filing jointly) made in one year may be included in his or her estate for estate tax purposes. Please consult your tax and/or legal advisor for further guidance.

2Non-qualitied withdrawals from a 529 plan are subject to income tax and a possible 10% federal penalty on the earnings portion of the account.

Even more flexibility

No longer just for college

529s can now be used to pay down student loans

According to the SECURE Act, which became law on December 20, 2019, families can now use their 529 college savings plans to repay up to $10,000 in qualified student loans. These can be loans owed by the student or their siblings.

This means even greater flexibility for using 529 savings.

K-12 tuition, another avenue

After passage of the Tax Cuts and Jobs Act in 2018, 529 plans have expanded to distribute up to $10,000 per student per year to cover K-12 tuition incurred at public, private or religious elementary or secondary schools.

Move assets to a Roth IRA

Beginning in 2024, beneficiaries of 529 accounts that have been in place for 15 years or more will be able to move assets from their 529 to a Roth IRA. Among other restrictions, the transfer is subject to the beneficiary’s annual contribution limit as well as a lifetime maximum of $35,000. Contributions or earnings from the past five years can’t be rolled over. And the Roth IRA accepting the funds must be in the same name as the 529 plan beneficiary.

Some states have not adopted the SECURE Act provisions. If you withdraw funds for qualified student loan payments and live in a state that doesn’t follow the Federal SECURE Act provisions, you could be subject to state tax penalties, including a 10 percent penalty on non-qualified withdrawals.

Beginning in 2024, beneficiaries of 529 accounts that have been in place for 15 years or more will be able to move assets from their 529 to a Roth IRA. Among other restrictions, the transfer is subject to the beneficiary’s annual contribution limit as well as a lifetime maximum of $35,000. Contributions or earnings from the past five years can’t be rolled over. And the Roth IRA accepting the funds must be in the same name as the 529 plan beneficiary.

The journey from kindergarten to college

Planning ahead is the key. Some tips for using 529 savings for K-12 expenses.

Know your state’s tax handling

Some states have not adopted the Tax Cuts and Jobs Act updates. Withdrawing funds for K-12 tuition payments in a state that doesn’t follow the Federal SECURE Act could subject you to state tax penalties or your ability to claim credits/ deductions could be affected. You may also trigger a 10% penalty on non-qualified withdrawals.

Start early

Consider contributing once your child is born rather than when they’re already at school age

Make it a family affair

Get help from family to ensure you’re meeting both K-12 and college education milestones. It’s an excellent legacy planning opportunity

Consider higher contributions

Maximizing your contributions can ensure that you have enough to fund both K-12 and post-secondary education

Ensure your investment strategy is aligned

You may need to switch your savings approach or portfolio. Your financial professional can help you look at the big picture

No matter your educational path, a Section 529 Education Savings Plan Account can help with the journey

Thought 529 plans are just for college tuition? 529s can also cover vocational school tuition and a wide range of other related expenses

Vocational and trade school

Off-campus housing

Food and meal plans

Books

Computers and software

Special needs equipment

Withdrawals from 529 Plan accounts that are not used to pay for qualified higher education expenses of the beneficiary are subject to federal taxes (including a 10% federal penalty tax) such that any tax benefits of the 529 Plan will be lost.

A financial professional can help you save for education … and beyond

A financial professional can help with:

Comprehensive financial planning

Seeing and planning for the big picture — education savings, retirement planning and legacy planning goals

Robust asset allocation choices

Helping you select appropriate investments based on your objectives and investment risk tolerance — both active and passive strategies — with the objective of meeting your savings goals

Investing discipline

Disciplined investing isn’t easy — your financial professional can offer advice in maintaining your savings plans and focusing on your long-term goals

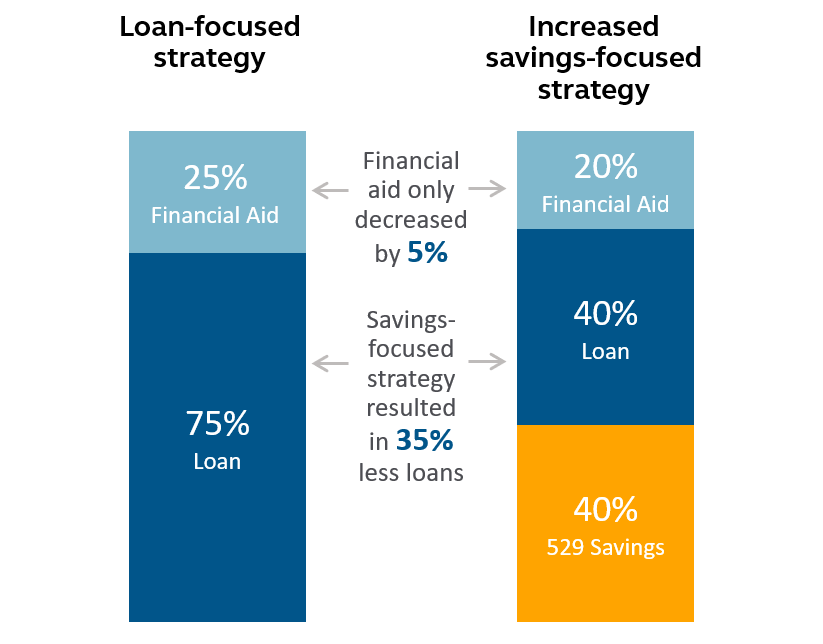

Myth #1: 529s will affect my child’s eligibility for financial aid

Saving now means potentially borrowing less later

Sophie’s family: Savings-focused education funding strategy

Assume Sophie’s education costs $100,000 and her family saved a portion of that in a 529 plan. This reduced the amount of loans she would have to take, but did not create a large reduction in the amount of financial aid received.

For illustrative purposes only.

A 529 strategy reduces out of pocket costs and student loans

A college education costs, on average, approximately $104,000 for a four-year, in-state school for tuition and fees, room and board, books and supplies, as well as transportation.

| 100% through a 529 plan | 50% through a 529 and 50% through student loans | 100% student loans | |

|---|---|---|---|

| Scenario | A family invested $247 monthly for 18 years in a 529 plan | A family invested $123 a month in a 529 plan. The student then takes out a student loan for $51,780 (payable over 10 years) | A student finances her entire $104,000 expense through student loans (repaying over 10 years) |

| Investments | |||

| Monthly investment | $247 | $123 | − |

| Years | 18 | 18 | − |

| Growth rate | 7% | 7% | − |

| Total invested | $53,352 | $26,635 | − |

| Future value | $104,554 | $52,197 | − |

| Loans* | |||

| Loan amount | − | $51,780 | $104,000 |

| Interest | − | 4.25% | 4.25% |

| Years of repayment | − | 10 | 10 |

| Monthly payment | − | $530 | $1,061 |

| Loan total/debt | − | $63,650 | $127,301 |

| Total out of pocket | $53,352 | $90,285 | $127,301 |

*Assumes 10 years to pay off the loan and average annual return of 7% in the 529 plan account. This example’s assumed rate of return is not guaranteed, and actual returns will vary. These hypothetical examples are for illustrative use only and do not reflect an actual investment in any specific 529 plan.

What are your options for financial aid?

Financial aid is need-based and is determined by:

Cost of attendance - The Student Aid Index = Financial need

COA

Cost of attendance

- Reflects the cost of attending a specific school.

- Includes tuition, room, board, and related fees and expenses.

SAI

The Student Aid Index

- Amount a family is expected to contribute to education costs each year.

- Determined by FAFSA submission, not dependent on specific school's COA.

- Keep in mind: SAI does not always reflect a family's actual ability to pay.

FAFSA®

Free Application for Federal Student Aid

- Helps to determine amount of federal aid families are eligible for.

- Used by many public, private, community, and vocational schools to calculate financial aid packages (the amount of aid—whether through grants, scholarships, or loans—offered by a school to a student).

Financial Aid

The FAFSA Simplification Act has changed federal college financial aid. This information is for the 2024-25 award year.

A simplified form

The FAFSA form is easier to fill out – it’s shorter, has fewer questions and many fields are prepopulated by the IRS.

Old

If parents are divorced/separated, the parent that provides the greatest financial support to the student must fill out the FAFSA.

New

A maximum of 36 questions that streamlines the process and draws information directly from tax forms.

From EFC to SAI

A new measure, the SAI, replaces the EFC to determine the ability to pay for college. A lower SAI signifies higher financial need.

Old

EFC assessed a student’s available financial assets to determine financial need.

New

SAI can move into negative territory, as low as -1,500, to give greater insight into those families with exceptional need.

SAI and siblings

For dependent students, education savings will only be counted as a parental asset if the account is designated for the student.

Old

For parents with more than one child attending college, all 529 accounts were counted.

New

SAI treats each student as an individual and is not divided based upon the number of students attending college within the same family.

Financial Aid

The FAFSA Simplification Act has changed federal college financial aid. This information is for the 2024-25 award year.

Grandparent-owned 529 plans

It’s now easier for grandparents to play a bigger part in funding a grandchild’s education.

Old

Funds withdrawn from a grandparent-owned 529 were included in the FAFSA “income test”.

New

Distributions from non-parent-owned 529 savings accounts, i.e. grandparent-owned, will not be counted as student untaxed income.

Work-sponsored retirement accounts

Pre-tax contributions to retirement accounts will no longer be counted in a family’s ability to pay for college.

Old

Families disclosed contributions to work-sponsored retirement accounts, which counted as income.

New

Work-sponsored accounts, including 401(k)s, IRAs and Roth IRAs are no longer included in FAFSA financial aid calculations.

Custodial parent definition changes

If parents are divorced/separated, the parent that provides the greatest financial support to the student must fill out the FAFSA.

Old

The parent that files is the one the student lived with (or lived with most) in the 12 months prior to applying.

New

Parent providing the most financial support for the student in the 12 months prior to applying is the one that files. Child support is an asset, not income.

A closer look at applying for financial aid

Free Application for Federal Student Financial Aid (FAFSA®) needs to be applied for every year in college.

Key dates

FAFSA forms must be submitted by 11:59 p.m. Central time (CT), June 30, 2024.

Each state also has its own deadline.

For more info, visit: studentaid.gov

When to apply

- Year 1: Apply in the year before attending college

- Year 2: Apply in Year 1

- Year 3: Apply in Year 2

- Year 4: Apply in Year 3

Additional considerations

In year 1 and year 2, consider using 529 plan account owned by parents. Withdrawals from parent-owned 529s not considered student income.

In year 3 and year 4, consider using 529 plan account owned by grandparents. Withdrawals from grandparent-owned and other-owned plans are not included in SAI calculations.

For illustrative purposes only

Grandparents and generational wealth transfer

Lessen your estate tax burden and empower future generations

- Potentially minimize some tax consequences with 529s

- Move asset out of your estate into a grandchild/beneficiary’s name

- Create a source of education funding that can go from generation to generation

- Account owner retains control

Idea: Consider using your required minimum distributions (RMDs) to fund a 529 plan, minimizing gift tax and growing/compounding tax free.

At age 73 you have to begin taking money annually out of your tax qualified retirement accounts (such as IRAs, 401k, 403b, 457b and Keogh) in the form of required minimum distributions (RMDs). These are taxable.

While Section 529 Plans can, under some circumstances be an effective way to facilitate intergenerational wealth transfer, a Section 529 Plan should be evaluated in light of other estate transfer planning vehicles such life insurance, trusts and other gifting strategies eligible for gift tax exclusions or gift tax exemptions. Your evaluation of wealth transfer objectives and of wealth transfer strategies should be conducted with the involvement of your tax advisors and an estate planning attorney. A Section 529 Plan does have limitations on account transfers and withdrawals are subject to penalties if not utilized for payment of qualified education expenses. This is general information and should be construed as tax or investment advice.

Myth #2: I have to open a 529 plan in my home state

You can choose a 529 plan that is out of state

529 plans are state‐sponsored, but that doesn’t always mean you have to use your in‐state 529 plan to save for college.

Any 529 plan can be used to pay for college in any state. You can use almost any state’s 529 plan, with very few exceptions where a residency requirement may exist.

Approximately 28 states offer a state income tax deduction or state income tax credit for 529 plan contributions.

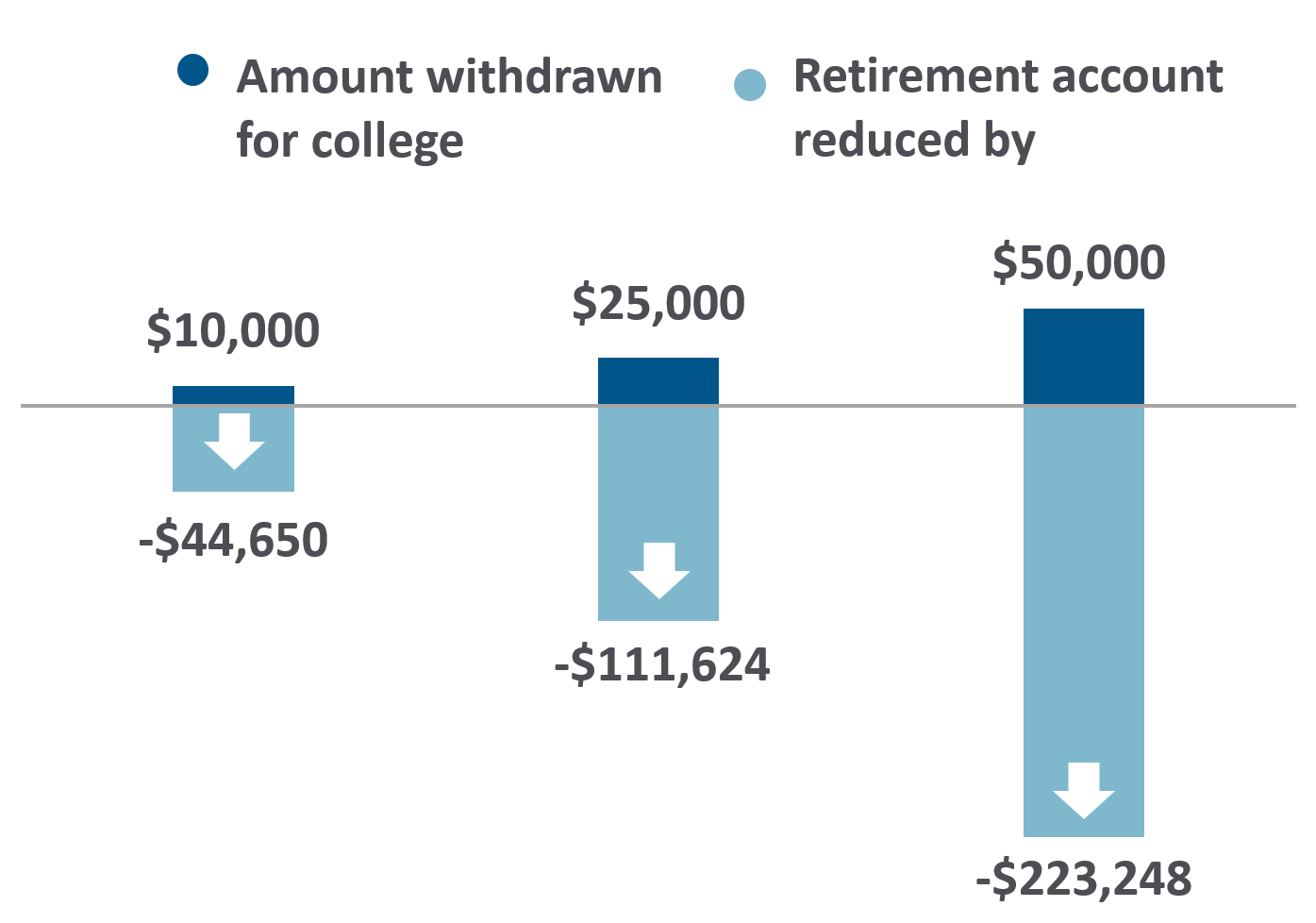

Myth #3: I can just use my retirement savings for my child’s education savings

The danger of using retirement funds for education is you lose the power of compounding

College withdrawals can jeopardize retirement security

Assume 6% interest, compounded monthly over 25 years. This chart is for illustration purposes only and does not represent the performance of any specific investment.

Save.

Investment returns make a difference

Save with the help of an experienced asset manager

Principal Asset Management

As a global leader in asset management, we are focused on harnessing the potential of every opportunity to secure an advantage for our clients.

- 27th largest manager of worldwide institutional assets.1

- 12-year winner of Pensions & Investments’ annual Best Places to Work in Money Management, earning a spot every year since the program launched.2

- A fiduciary with disciplined processes, specialized expertise across asset classes, and global investment capabilities in both public and private markets.

As of June 30, 2024. See Important Information page for AUM description. Due to rounding, figures and percentages shown may not add to the totals or equal 100%. 1434 Managers ranked by total worldwide institutional assets as of 31 December 2022 “Largest Money Managers,” PENSIONS & INVESTMENTS, June 2023. 2Pensions & Investments, “The Best Places to Work in Money Management” among companies with 1,000 or more employees, December 2023.

Why Scholar’s Edge?

Making brighter tomorrows a reality through smarter choices for education savings

Legacy of creating brighter tomorrows

- Deep asset allocation expertise—Principal is the largest provider of active, multi-managed target date funds in the United States1

- Institutional-quality portfolio construction

- Robust and sophisticated glide path technology

Smarter outcomes through choice, value, and peace of mind

- Comprehensive range of investment options

- A capital preservation portfolio

Committed and dedicated partner

- An ideal opportunity to invest as a family

- Knowledgeable teams supporting Scholar's Edge across various Principal business units

- Extensive tools and resources to support you in the college savings journey

1Based on Sway Research, The State of the Target Date Market: 2024. Rating refers to assets under management in the U.S. market. This ranking includes both hybrid and actively managed Target Date mutual funds and CIT funds.

Smarter outcomes through portfolio options

Multi-asset, multi-manager strategies combining the advantages of active management and the cost savings of passive management

11 Year of enrollment portfolios

Designed for those beneficiaries who are expected to enroll in qualified education programs between the target years of the portfolio.

Seek to achieve long-term growth of capital while preserving capital as they approach their applicable target year of enrollment date.

4 Target risk portfolios

Provide access to broad asset classes, combining exchange traded funds, mutual funds and life insurance funding agreements.

Allocations gradually becoming more focused toward capital preservation and volatility control as the risk target becomes more conservative.

15 Individual portfolios

Investors may choose from a wide variety of investment options to create their own personalized investment plan.

- Available in A, C and R unit classes. Download our Asset Allocation flyer (PDF).

- The Scholar’s Edge Capital Preservation Portfolio contains a guarantee by Principal Life Insurance Company that its annual interest rate will be at least one percent.1

Unit class availability varies by broker-dealer. Please check with your firm for details on how the plan is offered.

1The Portfolio invests 100% of its assets in the Scholar’s Edge Guaranteed Contract issued to the Plan by Principal Life Insurance Company. Under the Contract, principal and a rate of interest are guaranteed to the Plan by Principal Life. Principal Life guarantees the interest rate under the Contract will be at least 1%. The Portfolio is subject to the risk that Principal Life will become unable to make its payment obligations under the Contract.

Share class availability varies by broker-dealer. Please check with your firm for details on how the plan is offered.

Glide path innovation

Discover how your portfolio's asset allocations change over time.

Creating an asset class mix designed to help manage investment risk at every time frame up to the expected year of enrollment:

- Non-linear glide path designed to minimize volatility in the Year of Enrollment Portfolios before education funds are needed

- Utilizes a number of investment managers and their disciplines – choosing active managers for the asset classes where it matters most to assist with portfolio diversification

- Active asset allocation and monitoring by dedicated manager research team

- The investment management team has deep asset allocation expertise, also managing the Principal target date funds

Dynamic glide path, built using:

- Educational statistics

- Average savings rates and forecasts

- Demographic and census data

- Tuition growth forecasts

- Risk assumptions

Start by selecting the estimated years until enrollment and interact with the graph to view selected asset categories or click and drag within the graph to zoom into a specific time frame.

- +Years

Selected Year of Enrollment Portfolio:

Asset allocation and diversification do not ensure a profit or protect against a loss. The investment manager’s investment philosophy and strategy may not perform as intended and could result in a loss or gain.

Benefits of Scholar’s Edge 529 Plan

Accessibility

We provide online resources and tools to easily manage your account across a range of topics:

- Additional contributions

- Withdrawals

- Investment changes

- Changes to banking instructions

- Changes to delivery preferences

- Profile updates

- Access to education savings resources

- Automatic Investment Programs (AIPs), like payroll direct deposit, allow you to ‘set it and forget it’. Start the process by downloading our payroll direct deposit form (PDF).

Flexibility

We’ve improved Scholar’s Edge to make life’s important choices even easier.

- Comprehensive range of investment options

- Low minimum investment with as little as $1

- High maximum investment of $500,000 per beneficiary

- No income limit – no matter your salary, you can start saving in the Scholar’s Edge 529 Plan

The power of compounding

Time is on your side

Assume 6% interest, compounded annually, in a non-taxable account. This chart is for illustration purposes only and does not represent the performance of any specific investment. Investment returns are not guaranteed and you can lose money by investing. Investors should consider their ability to sustain periodic investment programs during periods of market downturns.

Coffee break vs. tax break

Every little bit can make a difference to help a child realize their dreams

Putting it in context ...

By purchasing 1 coffee per week, you could have had:

= $4,648

= $4,648Amount spent on 1 coffee per week over 18 years: $2,583

By purchasing 1 meal per week, you could have had:

= $18,593

= $18,593Amount spent on 1 meal per week over 18 years: $10,368

By purchasing 5 coffees per week, you could have had:

= $23,164

= $23,164Amount spent on 5 coffees per week over 18 years: $12,917

By purchasing 5 coffees and 1 meal per week, you could have had:

= $41,757

= $41,757Amount spent on 5 coffees and 1 meal per week over 18 years: $23,285

Assume 6% interest, compounded monthly over 18 years. Assume 4 weeks per month for calculation of monthly cost. This comparison is shown for illustration purposes only and does not represent the performance of any specific investment. Assumes a contribution into a non-taxable account. This investment return assumption is not guaranteed and you can lose money by investing.

Sources: Cup of Coffee ($2.99): https://www.marketwatch.com/story/why-your-latte-costs-nearly-5-despite-plummeting-coffee-bean-prices-2019-04-26; https://finance.yahoo.com/news/why-the-price-of-coffee-is-rising-despite-falling-bean-prices-154605967.html; Cost of Meal ($12.00): https://www.franchisehelp.com/industry-reports/fast-casual-industry-analysis-2018-cost-trends/

It’s easy to give the gift of education with Scholar’s Edge

Opportunities for contribution and gifting

Ugift®

Gift contributions with Ugift®, an easy, free-to-use feature of Scholar’s Edge to help fund your child's education. Friends and family can use your account’s unique Ugiftcode at any time to easily make gift contributions at Ugift529.com.

Upromise®

Join Upromise for free and then buy groceries, shop online, book travel, dine at restaurants, and more—through participating partners. A percentage of your eligible spending will be deposited in your Upromise account. Signing up at Upromise.com is fast, easy, and secure.

You can easily link your Upromise account with your eligible 529 account and have your education savings automatically transferred into your 529 plan.1

Estate planning

Work with your financial professional to make 529s part of your estate planning process. Scholar’s Edge allows you to contribute the following per beneficiary:

• $18,000 individual

• $36,000 filing jointly

• Lump sum over 5 years ($90,000 individual, $180,000 filing jointly)

Contributions to your Scholar’s Edge account may continue until your plan reaches $500,000 per beneficiary.

1Upromise is an optional program offered by Upromise, Inc. and is separate from Scholar’s Edge. Specific terms and conditions apply. Participating companies, contribution levels, terms and conditions are subject to change. Upromise, Inc. is not affiliated with the Program Manager.

Disclosures

Scholar's Edge® ("Scholar's Edge" or the "Plan") is operated as a qualified tuition program offered and sponsored by The Education Trust Board of New Mexico (the "Board") and is available to all U.S. residents. Ascensus College Savings Recordkeeping Services, LLC is the Program Manager for Scholar's Edge and Principal Funds Distributor, Inc. is the distributor of Scholar's Edge. The Program Manager and the Distributor are not affiliated organizations.

Accounts in Scholar's Edge are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The securities held in the Plan accounts are neither FDIC insured nor guaranteed and may lose value. The Board has no legal obligation to provide financial support to the Plan or Plan accounts, and you should not expect that the Board will provide financial support to the Plan at any time. Account Owners do not invest in, and do not have ownership or other rights relating to the underlying investments held by the Plan's investment options. The underlying investments are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

This material is provided for general and educational purposes only, and is not intended to provide legal, tax or investment advice, or for use to avoid penalties that may be imposed under U.S. federal and state tax laws. Contact your attorney or other advisor regarding your specific legal, investment or tax situation.

Some states offer favorable tax treatment to their residents only if they invest in the home state's own plan. Investors should consider before investing whether their or their designated beneficiary's home state offers any state tax or other benefits that are only available for investments in such state's qualified tuition program, such as financial aid, scholarship funds, and protection from creditors, and should consult their tax advisor.

Before investing in the Plan, investors should carefully consider the investment objectives, risks, charges and expenses associated with the Plan's municipal fund securities. The Plan Description and Participation Agreement contains this and other information about the Plan, and may be obtained by asking your financial advisor, by visiting scholarsedge529.com or calling 866-529-SAVE (866-529-7283). Investors should read these documents carefully before investing.

Scholar's Edge® is distributed by Principal Funds Distributor, Inc. a FINRA Member

711 High Street

Des Moines, IA 50392

Scholar's Edge® and the Scholar's Edge® Logo are registered trademarks of The Education Trust Board of New Mexico used under license.

Ugift is a registered service mark of Ascensus Broker Dealer Services, LLC. Upromise is a registered service mark of Upromise, Inc.

Assets under management attributed to Principal Global Investors includes the asset under management of the following members of Principal®: Principal Global Investors, LLC; Principal Real Estate Investors, LLC; Principal Real Estate Europe Limited and its affiliates; Spectrum Asset Management, Inc.; Post Advisory Group, LLC; Columbus Circle Investors; Finisterre Capital; Origin Asset Management, LLP; Claritas Investimentos; Principal Global Investors (Europe) Limited; Principal Global Investors (Singapore) Limited.; Principal Global Investors (Australia) Ltd.; Principal Global Investors (Japan) Ltd.; Principal Global Investors (Hong Kong) Ltd., and include assets where Principal Global Investors and its affiliates provide model portfolios.

All figures shown in this document are in U.S. dollars unless otherwise noted. All assets under management figures shown in this document are gross figures and may include leverage, unless otherwise noted. Assets under management may include model-only assets managed by the firm, where the firm has no control as to whether investment recommendations are accepted, or the firm does not have trading authority over the assets.

© 2024 Principal Financial Services, Inc. Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.